Industry 4.0, digital transformation is now no longer a choice; it is an inevitable development trend for businesses, consumers and society. In Vietnam, Digital Banking has become a cornerstone of financial software development. As a report, 94 percent of banks in Vietnam are investing in digitization, and 42 percent of them consider digital baking a top priority. So, banks are stepping up their digital transformation to better serve their customers and improve overall banking experiences.

Vietnam's digital transformation potential

In recent years, Vietnam's banking industry has been a pioneer in joining the Fourth Industrial Revolution. Specifically, Vietnamese commercial banks have quickly adapted to and applied financial technologies (Fintech) to banking operations, such as mobile and QR code payments, electronic wallets, tokenization, payments via chip cards for domestic cards, etc. Those strong transformations have helped Vietnam’s banking sector improve its competitiveness and expand the access to banking services of all people, especially those in the rural and remote areas.

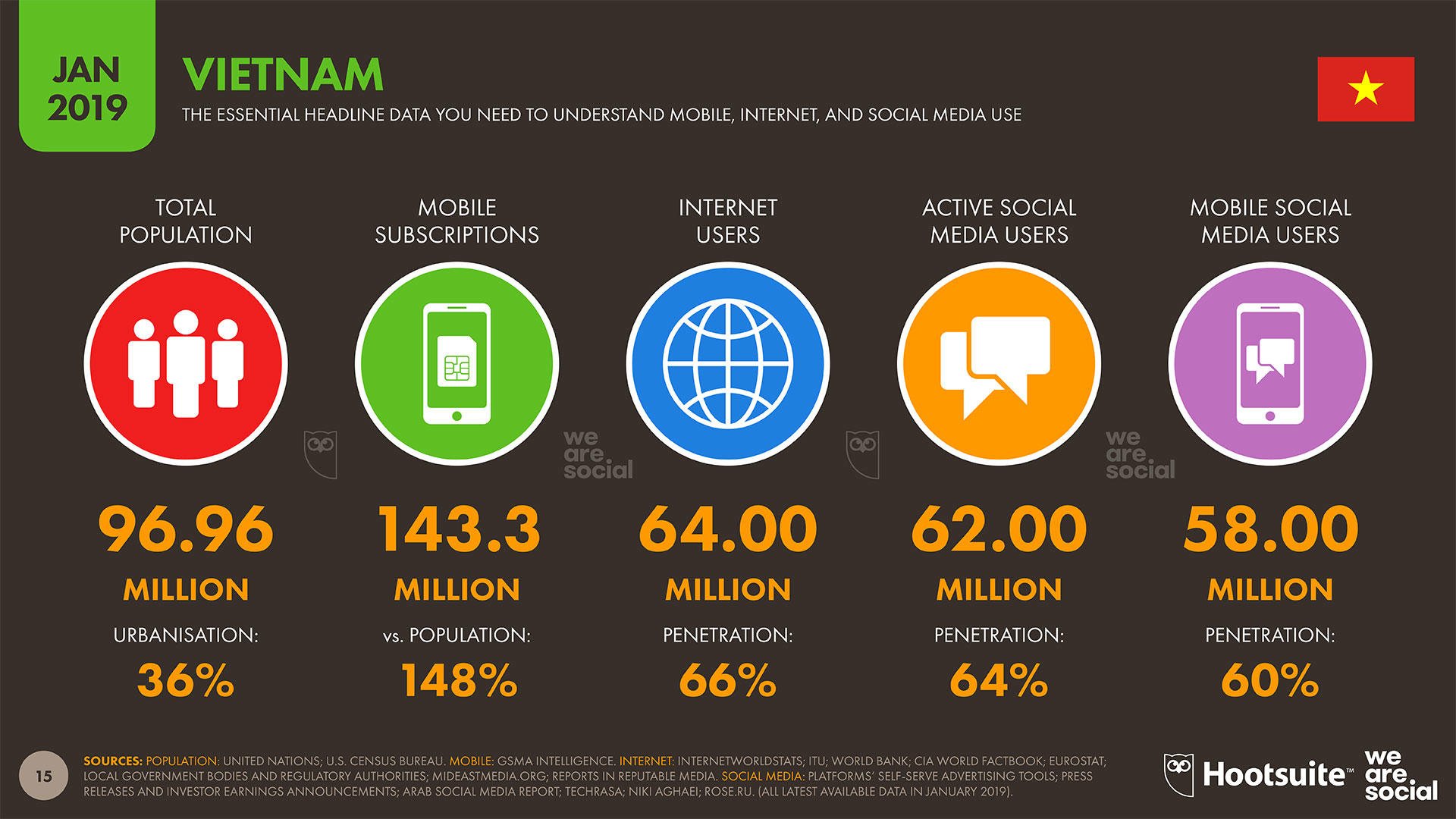

Vietnam has many favorable conditions for the development of digital banking thanks to its large population of 96 million people, a golden population structure (56 million people participating in the labor market); the smartphone ownership ratio is quite high (72%), with 62 million subscribers with 3G/4G internet connection, and a young population who are fancy of technologies.

Rate mobile, internet and social media use young people in Vietnam

Rate mobile, internet and social media use young people in Vietnam

Besides, the middle class in Vietnam has been growing the fastest in Southeast Asia, which promises great potential for finance, banking, and insurance sectors.

So, banks are under increased pressure to optimize their user experience and to create personalized service experiences for each customer. Digital transformation will help Vietnam’s banks do this more effectively.

Read more: "What Does Digital Transformation in Banking Really Mean?"

Vietnamese banks accelerated digital transformation

Vietnamese banks are well aware of the importance of digital banking transformation; therefore, over the past time, they have proactively studied and tried new technologies for applying to their business operations and have initially achieved certain results.

Statistics of the State Bank (SBV) show that Vietnam now has 70 credit institutions and payment intermediaries such as e-wallets that have provided payment services via the Internet. The value of financial transactions via the Internet channel has reached over 7 million billion VND (US$ 300 billion) and 300 trillion VND (US$ 13 billion) traded via mobile phones, according to Law Plus.

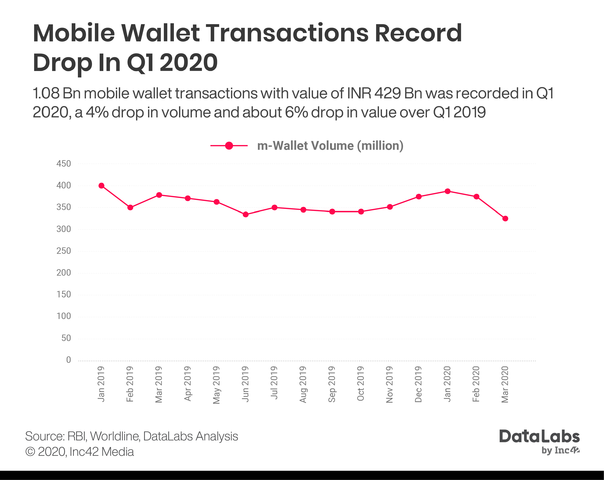

According to NAPAS, electronic payment in the first quarter of 2020 increased by 76%, the total value of transactions increased by 124% over the same period in 2019. Digital financial transactions boomed in the first quarter of 2020.

Mr. Nguyen Chien Thang, Director of BIDV Digital Bank, said that digital banking is one of the three pillars of BIDV's development strategy to 2025 and vision to 2030. Accordingly, BIDV will focus on digitizing distribution channels, transaction systems, interacting with customers...to move towards comprehensive digitalization.

Not only BIDV, but many other banks have been racing to develop digital banking. In fact, each bank has a different orientation to digital banking, depending on its customers. If Timo Digital Bank under VPBank is at the forefront of the digital banking revolution with the policy of fewer branches and transaction offices, TPBank has a strategy of density coverage with automatic ATMs (LiveBank)...

Vietnamese banks face challenges in digital banking transformation

Challenges related to network security, customer trust and an inadequate legal framework are roadblocks to the digital transformation of Vietnamese banks.

Network security

In Vietnam, security risks such as fraud, customer fraud, cyber attacks on banking infrastructure and leaked user data are increasing. According to Ernst & Young Vietnam, 8,319 cyber attacks occurred on banks last year and 560,000 computers were affected by malware capable of stealing bank account information.

Banks faced losses of US$642 million caused by computer viruses, while only 52 percent of customers worried about security while using online banking.

Customer trust

Vietnamese have kept the habit of using cash for a long time. So, 90% of payments for e-commerce transactions are done through cash delivery because customers do not trust the seller and the shipper.

According to the report, about 30% of the population has a bank account and 70% has a smartphone with an Internet connection. However, only 20% of customers conduct transactions online.

Legal framework

The incomplete legal framework is a major barrier to digital banking transformation in Vietnam

The incomplete legal framework is a major barrier to digital banking transformation in Vietnam

Vietnam has not yet completed the legal framework for banks to share, store and exploit data with services such as banking, telecommunications and insurance. This is a big challenge for Vietnamese banks to accelerate digital transformation.

A clear legal framework for user data security and information security to create a safe and reliable digital transaction system for banks.

Read more: "Reliable Digital Banking Transformation Consultant in Vietnam"

If you are looking for a Digital Banking Transformation Consultant to provide solutions for your company, we’re happy to grant our services. Contact experts at Innotech Vietnam for any questions about Digital Transformation!

Email: info@innotech-vn.com

Comments

Post a Comment